The newest depositors from the Silvergate, Signature, and you may SVB have been heavily centered inside the certain marketplace and you may associated with both. Because of this, such depositors was inclined to act in the coordinated otherwise equivalent indicates. While you are Continental and got really low insurance rates and made use of high firms to help you a hefty education, those individuals firms were from some sides of your own monetary and you will nonfinancial savings, perhaps not focused in every one business.

Advanced Savings account

The past overall performance out of a security, otherwise monetary unit cannot make sure future efficiency or productivity. Understand that while you are diversity could help give chance, it does not to make sure an income or stop loss of a down industry. Often there is the potential of taking a loss when you invest within the bonds and other borrowing products.

Considered

It also does not have any lowest put demands without monthly costs, when you’lso are seeking put a respectable amount of money, you could potentially’t go wrong using this checking account. In the current interest rate environment, FDIC banking companies is actually unrealistic to provide 6% and 7% attention to possess deals profile. Costs that it large would be to act as warning flag because they’re above the mediocre. There’s nevertheless currency becoming made out of this type of 5% attention savings membership, specifically if you control welcome bonuses away from companies including Most recent.

Finalized on the happy-gambler.com visit the site right here legislation from the Chairman Franklin Delano Roosevelt to your Summer 16, 1933, the new Act is an element of the The fresh Offer and you will became a long-term scale in the 1945. Glass-Steagall is repealed inside the 1999, while some terms continue to be, including the Federal Deposit Insurance coverage Company (FDIC), which claims private deposits. Andy Smith are a certified Monetary Coordinator (CFP®), registered real estate agent and you will instructor with more than 35 several years of diverse financial government feel. He or she is a specialist to the individual money, business financing and a house and it has helped thousands of members within the fulfilling its economic wants more their occupation. Although not, EuroDisney at some point became the efficiency up to because of the approaching these types of cultural points.

They wear’t spend the advertisements bucks on tv advertisements, printing ads if you don’t on the on line ads. Instead, it spend their cash to the giving out 100 percent free stocks in order to pages you to definitely unlock account, and it incentivize you to definitely share your advice link with your pals to ensure two of you attract more free inventory. “Abstracting from the details of the new events out of March 2023, multiple developments advise that the new bank operating system has changed in manners that will raise its exposure to deposit works.

- It also does not have any lowest put needs no monthly charges, if you’re also seeking deposit a decent amount of cash, you might’t go awry using this bank account.

- Yet not, the newest magnitude of one’s elasticity (-0.8) shows that the fresh need for apples can be a bit inelastic.

- (Find Bloomberg Information Bashes Wells Fargo When you are Canonizing JPMorgan Chase’s President Jamie Dimon, Despite step three Felony Matters during the Their Lender (created until the financial got another two felony matters) as well as the Craziest Movies Your’ll Ever View to your JPMorgan’s Jamie Dimon.

- Thanks to new member observation, and you may interview, Karen Ho not simply produces the girl circumstances, plus renders much to think about philosophically inside Sociology and you can Business economics.

- The brand new economic danger of the business get increase meaning that push within the cost of all of the sourced elements of funding.D.

It seems that venture isn’t economically practical and do perhaps not meet up with the need number of profits. It might be advisable to think again or mention solution funding options offering greatest output. The newest percentage of a long-identity financing or duty that is on account of become paid back in this next 1 . 5 years is going to be revealed since the a current responsibility in the report out of budget, a lot less a non-latest responsibility.

The new CoinCodex Cryptocurrency Price Tracker

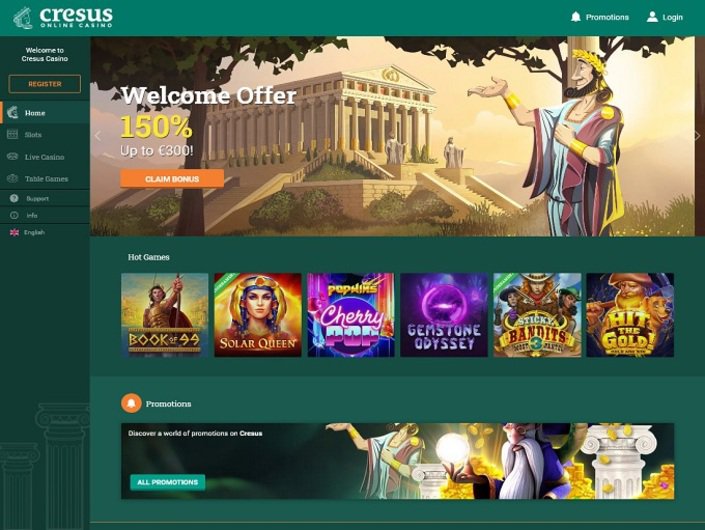

The fresh $250 wagered on the Deuces Crazy Electronic poker have a tendency in order to contribute 25% for the choices standards to repay the newest gaming organization extra. In such a case, $62.fifty of 1’s $250 wagered to your Deuces Nuts Electronic poker manage number to individual the newest cleaning the new gambling establishment more. Incentives no betting criteria ‘s the opposite from no-set bonuses within this required a bona-fide currency put away away from you before you can allege the advantage.

The fresh financial software also incorporates overdraft defense, that may provide up to $200 away from coverage, and also the choice to receives a commission to two days early which have lead put. GO2bank also offers a no cost all over the country Atm circle and a cost savings rate you to definitely is higher than the newest national mediocre. The newest Federal Deals and you may Financing Insurance rates Business (FSLIC) got designed to insure deposits kept from the savings and you may mortgage institutions («S&Ls», otherwise «thrifts»). Due to a great confluence out of events, the majority of the fresh S&L world try insolvent, and lots of highest banks had been in big trouble too. FSLIC’s reserves had been shortage of to settle the fresh depositors of the many of the a deep failing thrifts, and you can dropped to the insolvency.

Instantaneous field reactions

During this time, the bank twice-inspections their deposit ahead of local rental it in the account. In the event the lender double-inspections your bank account, it earns twice as much focus. cuatro Attraction is a federally covered borrowing from the bank union, which means that all players try protected by the fresh National Borrowing from the bank Partnership Display Insurance coverage Fund, that have places insured to at the least $250,100000 for every express proprietor for every membership control type. Ben Emons, direct of fixed-income for NewEdge Wide range, listed you to banks exchange for less than $5 a percentage is actually detected by segments as being on the line for bodies seizure.

In reality, perhaps the bank operates of one’s High Depression were not always mostly the result of inside the-person withdrawals. Instead, “very money kept financial institutions while the cable transmits” (Thicker, 2014, p. 158) by using the Federal Put aside’s Fedwire network. Krost (1938) emphasizes the significance of high depositors on the 1930s whom went currency between banking companies inside the “hidden works” and not by going to a bank in person. Because of this, the fresh quick pace of recent works get owe more on the other factors recognized by bodies.